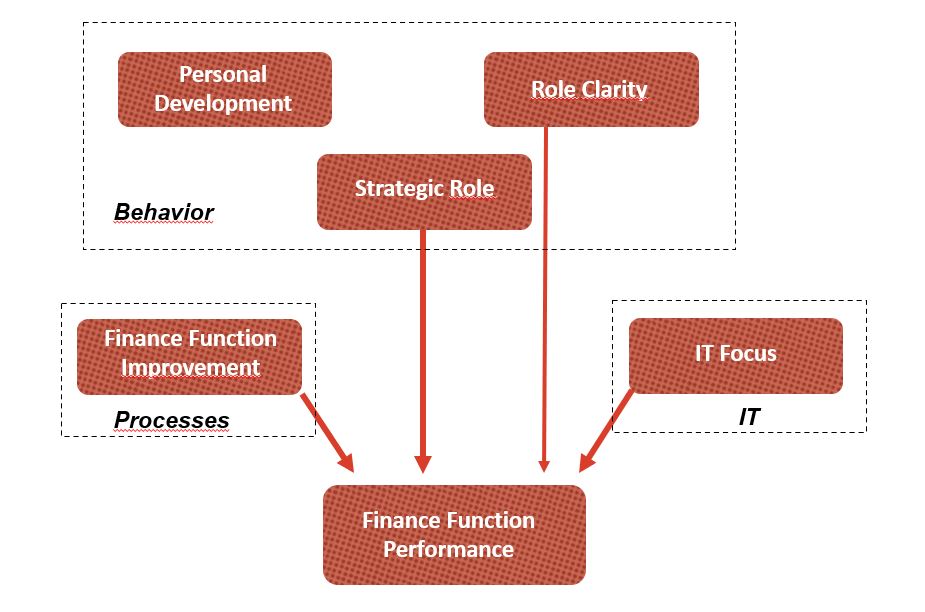

Based on evidence-based research FFR&D has developed a framework with which the Finance Function can start transforming itself into a high performance finance function. We call this the HPFF framework.

The purpose of this diagnosis is to evaluate how far a Finance function has progressed to high performance – i.e. to what extent the function is already set up and behaves like an HPFF – and then to determine what possibilities there are to make the Finance function stronger in a way in which the function can (even) better support the operation and can be a business partner for the management.

“The HPFF works proactively with the organization to become and remain an HPFF, by always having the right people, processes, and systems at a high quality level.”

Andrë de waal

The research into an HPFF is based on the ideas of high performance in organizations that André de Waal has developed. FFR&D Center has tested the relationship between the 5 factors of a high performance organization (1- Openness and action orientation, 2- Employee quality, 3-Long-term orientation, 4- Continuous improvement and innovation and 5- Quality of management) and the 5 factors of a high performance Finance function.

To transform the Finance function into an HPFF, using the HPFF Framework, the HPFF diagnosis was developed.

In practice, only a handful of high-performing Finance functions have successfully mastered the mix of culture, talent, governance model, technology and ability to improve required to become an HPFF. Most Finance functions still have too much time to spend on routine activities and therefore cannot play an active and important role in the strategic decision-making process in the organization. In addition, many Finance functions have more or less come to a standstill in their development because, for all sorts of reasons, they mainly have to concentrate on getting the basic processes in order and the reliability of the data and reports, and meeting the increasing compliance requirements. This has put a lot of pressure on the Finance functions that, thanks to ‘blood, sweat and tears’, often succeed in achieving the required basic performance: plans, reports, budgets and the annual accounts on time and approved by the accountant.