As in previous decades, organizations in the current era have to deal with many changes and disruptions in their environment. These can take the form of megatrends, defined as major social, economic, political and technological changes that develop slowly but, once present, will have an impact for a prolonged period of time, between seven and ten years or more. Another form is the disruptors, defined as someone or something that prevents something, especially a system, process or event, from continuing as usual or expected. The main difference between megatrends and disruptors is the speed at which they appear and the impact they have. That is, megatrends are changes that happen (often gradually) over a longer period of time, while disruptors are short-term, apparently unexpected, sharp changes with a high impact.

Both megatrends and disruptors can provide business opportunities, but more often than not they are seen as threats to future business growth or even the very survival of an organization. In order for organizations to adequately deal with megatrends and disruptors, or even take advantage of them, they must be strong and innovative enough to be able to prepare adequately. One type of organization ideally suited for this purpose is the high performance organization (HPO), defined as ‘an organization that achieves financial and non-financial results exceeding those of its peer group over a period of five years or more. longer by concentrating in a disciplined way on what really matters to the organization’. Mid-performing, let alone low-performing, organizations generally have great difficulty managing disruptions, as they often require a modified or new business model and new ways of working. On the other hand, it is known that HPOs can cope well with changing circumstances because of their flexibility and adaptability. This is partly because all parts of that organization are high-performing. For the finance function, this means that it is an HPFF, or high-performance finance function.

“How can an HPFF best prepare for the megatrends and disruptors, so that it continues to support the organization at a high level at all times?”

Unfortunately, the academic and professional literature on HPFF does not provide much support in this area, as little has been published on the subject. A study in this area on HPOs has recently been published (de Waal & Linthorst, Megatrends, disruptive forces and their postulated impact on organizations, paper for the EURAM Conference 2020), but such a study is not yet available for HPFFs. To fill this gap in the literature and thus help financial functions prepare for future developments, we launched a study. That research aims to identify how HPFFs should adapt to megatrends and disruptors in such a way that they can support the organization at a high quality level in achieving excellent results, even in a turbulent future.

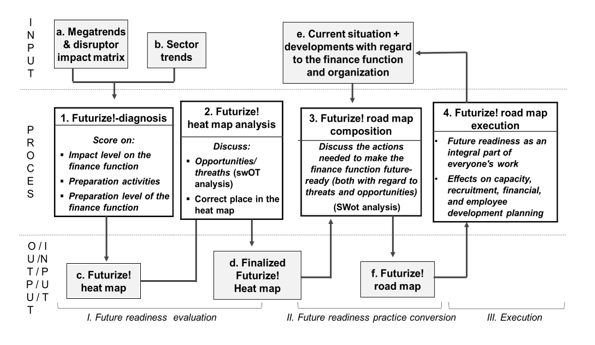

There are three phases and three processes in the ‘Futurize the finance function process’. The financial function starts with the future-readiness evaluation phase, followed by converting the evaluation results into practical improvement actions, which are put into practice in the execution phase. Each phase has an input and an output to the next phase, with the process itself taking place in between.

In step 1 ‘future readiness evaluation’ phase, based on the impact matrix (a in the future-readiness process) and the sector trends (b) – which should be seen as the impact matrix of global megatrends and disruptors, not sector specific developments – a select group of people from the organization (often management team members supplemented with specialists) scores each megatrend and disruptor (1 from the image):

Based on the average score of the participants, a draft Futurize! Heatmap constructed (c). A heat map is a two-dimensional table that lists risk on the y-axis (based on the impact of the risk) and risk probability on the x-axis. So, a heat map can be used to prioritize risks. We’ve replaced “risk probability” with “estimated preparedness” so that the heat map reflects the urgency the organization needs to deal with and prepare for a megatrend or disruptor:

The draft heat map is the input for a discussion in a larger group of representatives in the organization (2). During this discussion, each megatrend and disruptor is evaluated on its impact, which can of course be either positive or negative (‘opportunity’ or ‘threat’ in a SWOT analysis, and degree of preparedness, until the megatrends/disruptors are in the right place in the the final Futurize heat map (d) This heat map prioritizes the megatrends/disruptor that are most urgent to tackle by the organization.

Finally, in step 3 ‘Execution’, the road map is implemented by interweaving the Futurize actions in the daily practice of the finance function, based on realistic targets in time and work based on capacity, recruitment, financial, and employee develop plans (4). These plans are looped back into the overview of the current situation of the organization and the finance function (e) so that the road map can be updated at any time with the current circumstances and events.