One of the most important support functions in any organization is the finance function. After all, this position maintains relationships with all organizational units and simultaneously operates at the management team level. Therefore, it is important that this position transforms into a High Performance Finance (HPFF) position so that it can lead the transformation of the organization into a High Performance Organization (HPO). Becoming an HPFF is important anyway, not only because the organization is placing increasing demands on the finance function, but also because the need for high quality real-time management information and strategic analysis is increasing in the present day. Becoming an HPFF requires an investment of time and money. For the finance professional, the benefits of the improvement are obvious and getting approval and budget should be a piece of cake. In practice, however, it turns out to be difficult to actually obtain that approval, and this is often only partially successful or even not possible at all. What is the right approach now?

After a study of the literature, it appears that there is little to be found in it about the way in which approval can be obtained, and that limited research has been done into the best approach to obtaining budget for improvement programs. We therefore intend to use the Delphi technique to find an answer to the above question.

“How do I get approval and budget for an HPFF transition that is mainly internally focused (after all: within the finance function) and where the revenues will be mainly indirect in nature?”

We conducted a three-step Delphi survey:

The Delphi method structures and facilitates group communication that focuses on a complex problem, allowing the group to reach consensus on a future direction or solution over a series of iterations. The Delphi method has five characteristics:

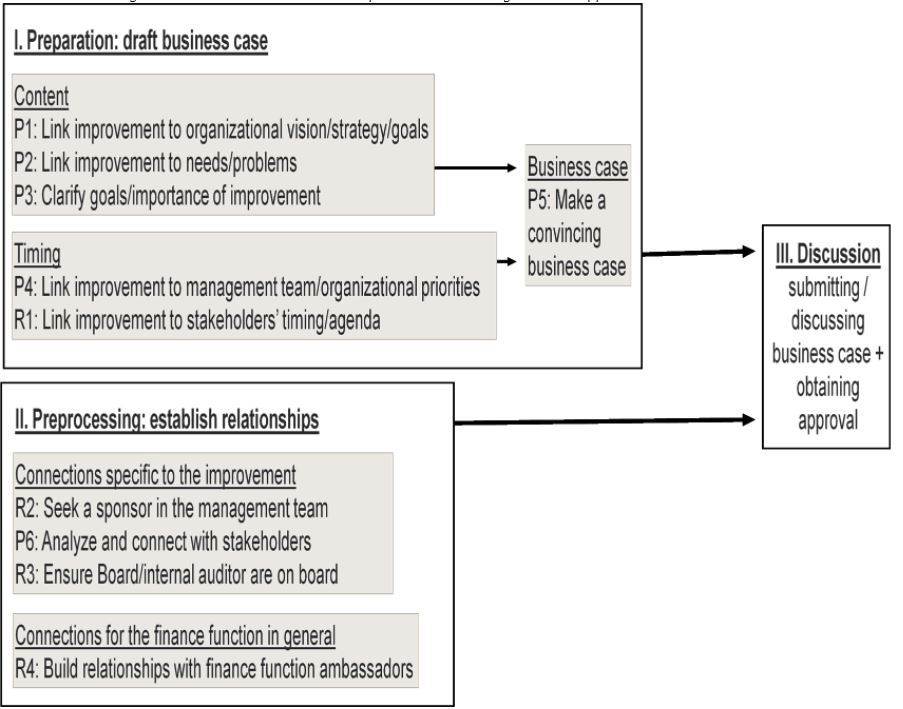

The study yielded 10 effective practices, with the experts emphasizing that these practices combined are so effective in practice. It turned out that there were two types of practices: process-based practices (6 items) that mainly concern the process of applying for the improvement budget, and relational practices (4 items) that deal with building and maintaining good relationships with stakeholders of the financial function so that they will support the budget request in due course. The figure shows schematically how the experts have ranked the selected methods of action.

Make a strong business case

The figure shows that successfully obtaining an improvement budget takes place in two parallel steps. During step I, a business case for the improvement and the necessary budget are compiled. The experts emphasized that this is not only about putting together a financial business case, but also about a qualitative business case that clearly shows the need for change. In step I, a distinction is made between the content of the correction and the timing that the correction is to be performed. With regard to content, the experts state that the requested improvement in the finance function should benefit the organization by supporting the achievement of the vision/strategy/goals and priorities of the organization and the management team (P1 and P4 in Figure 2) , whether it addresses specific problems in the organization or specific needs of the operation (P2). In both cases, it is essential that the purpose of the improvement and its importance (not only for the finance function but for the entire organization) is clearly made clear and explained (P3). From a relational point of view, it makes sense to align the improvement with the agenda of the most important stakeholders in the organization (R1). By properly aligning both the content and the timing of the improvement with what is going on in the organization, a strong business case is created (P5).

Build relationships with key stakeholders

Step II actually starts before step I and continues even after the business case has been delivered and presented. In this step, relationships are built and maintained with the most important stakeholders of the organization so that they can (start) act as ambassadors of the financial function and will support budget requests (P6 + R4). In addition, support can be sought for specific improvements by, for example, identifying within the management team who could benefit most from the improvement and who will support the budget request on that basis (R2). Another way is to inform the board and/or the internal auditor about the improvement and to make it clear to them that implementing this improvement will help the organization be more in control (R3).

Only when step I and step II have been properly performed, the time has come to present the business case to the management team in order to obtain, after discussion, the approval and budget for the proposed improvement (step III)