In 2016, the book How to Build a High Performance Financial Function was published. Based on that book, we took the next step and developed the high performance financial function (HPFF) framework. This is a scientifically validated framework, consisting of four factors (IT utilization, Efficiency and Effectiveness, Employee development, and Strategic Role) that have a direct positive relationship with the performance of a finance function. When a finance function strengthens these factors, it will perform better and add more value to the organization.

In practice, we have noticed that it is regularly noted from the CFO in particular that they are not yet ready to create an HPFF because all kinds of preconditions have not yet been met: “there are no good IT systems, we do not have the right people, we don’t have time for it, …”. This gave us the idea to determine what the hygiene factors are for a transformation to the HPFF: what needs to be in order or at least taken simultaneously to enable a successful transformation to the HPFF? To our surprise, however, there is no list of hygiene factors that everyone agrees on (even if a distinction is made, for example, according to type of organization). The scientific literature gives no reference at all, there is nothing to be found about the barriers and obstacles on the way to the HPFF. Hygiene factors can be found in the professional literature (often written by consultants or trade unions), but there is no consensus there either.

“What are the most significant obstacles a finance function must deal with to initiate a transition to a high performance finance function?”

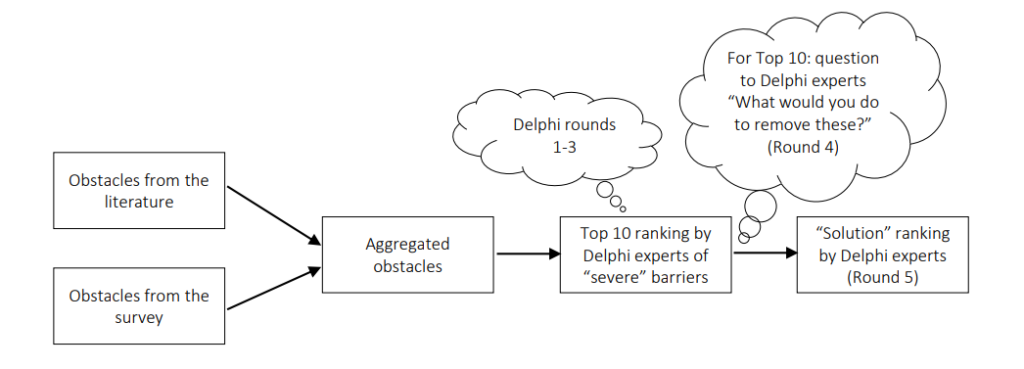

We decided to make this list ourselves, in a scientific way. We do this in two phases:

Outcome of the survey: a top ten list of obstacles that prevent finance from embarking on a trajectory high performance finance function:

Obstacle 1. Inefficient and non-integrated processes in the organization

Supporting the line requires having data, processes and systems in order. In practice, the finance function struggles to obtain the integrated data needed for management information from the misaligned processes. This obstacle can be tackled by: appointing owners in the organization for the improvement of chains, processes, applications and data; ensure a multidisciplinary team that maps processes/data/systems, identifies bottlenecks and implements solutions; and together with the line to make an improvement plan and to implement it consistently.

Obstacle 2. Data not (yet) in order within the organization

Financial functions have traditionally focused on data management: ensuring the reliability, security and privacy of data. In practice, it appears that many organizations have difficulty with this ‘data governance’. This obstacle can be tackled by: defining a data model that creates ‘one single version of the truth’; analyze the data carefully and use kaizen solutions for improvement; and to have the aforementioned multidisciplinary team take up the ‘data governance’.

Obstacle 3. Insufficient leadership and will to change of the CFO/F&C manager

In most financial functions, the requirements are met with ‘blood, sweat and tears’ every month, but there is insufficient room for structural improvement. To make time for this, it takes courage and leadership from management to say more ‘no’ to the line. In practice, this often turns out to be lacking. This obstacle can be tackled by: showing management how successful peers improve their finance function (after all, good example is good to follow); to ensure that there is a financial with authority at the top of the organization who is listened to when he / she pushes for improvement; and create the urgency for change in the CFO/F&C manager, for example by showing how internal customer satisfaction is decreasing.

Obstacles 4. Insufficient culture of change and improvement within the finance function

Financial employees are generally not trained in change management skills, because there is little attention for this during their training programs. This obstacle can be addressed by: as a CFO/F&C manager leading by example regarding change and improvement, by visibly working on the HPFF transformation; make it clear to management that making mistakes is allowed and learning is crucial, but sitting still is not an option for the finance function; and set up change/improvement teams with financial employees who have the ‘improvement gene’.

Obstacle 5. Inadequate ICT systems in the organization

Many organizations struggle with legacy systems that were implemented a long time ago and that no longer meet today’s user requirements. In order to remove those systems, organizations start implementations of new IT systems that unfortunately regularly do not go well. This obstacle can be tackled by: first improving the processes before purchasing a new IT system, otherwise ‘garbage in, garbage out’ will continue to apply; to ensure that ICT is placed higher on the strategic agenda of the organization as a business enabler; and to analyze whether the ICT problem lies with the ICT systems themselves or with the way they are set up within the organisation.

Obstacle 6. Lack of line management buy-in for the development of the HPFF

As soon as the finance function develops towards the HPFF, it will function more as a partner of the line management. This means that it will focus more on advising on the financial consequences of operational decisions. This is not always appreciated by line management because it may experience this as interference in its area. This obstacle can be addressed by: having regular dialogue with the line about what the finance function is doing and showing how the line benefits from a well-functioning finance function; allow the board of directors to testify openly that a strong finance function is critical to the organization; and to involve the line more in processes within the financial domain (after all: unknown means unloved).

Obstacle 7. Insufficient view/understanding of the business among financial employees

Due to the constant pressure, financial employees generally have too little time to delve into the operation in detail. This obstacle can be addressed by: having financials make regular in-line working visits and talking to operational staff and line managers; let financials participate in management teams and have internships open in the line; and as CFO to engage in more discussions with the financials about the business.

Obstacle 8. Insufficient financial employees with the right knowledge and skills

Specific competencies are required to be able to grow as a financial to the HPFF. This mainly requires all-rounders who can provide high-quality strategic and operational financial advice. This obstacle can be tackled by: mapping out the competencies needed to properly fulfill all roles in the finance function and selecting new staff accordingly; as management, to be open and transparent towards employees about the lack of the necessary knowledge/skills, and to point out to them that they also have an obligation to develop themselves; and deploy HR instruments such as ‘the fleet review’, which look at the quality of employees in a structural manner.

Obstacle 9. Insufficient/unclear business objectives and priorities within the organization

When there are unclear or no business objectives and priorities, it becomes very difficult for the finance function to meet the information needs of the line. This obstacle can be addressed by: taking the lead to develop organizational mission/vision/strategy/goals along with the line; determine together with the line what is really important for the organization and give that focus in the information provision; and on the line to ask about the purpose and why of certain things, and then together determine whether they are worth reporting.

Obstacle 10. Line management does not focus enough on analyzes and insights provided by the financial function

If the line pays insufficient attention to the ‘products’ delivered by the finance function, it can be assumed that it is not seen as a full partner. This obstacle can be tackled by: leading by example as a CFO by explicitly using the analyzes in the management team meetings; starting with small improvements and scoring with small projects based on the analyses; and the importance of the use of the analyses/insights by the board of directors to emphasize to the rest of the organization.